-

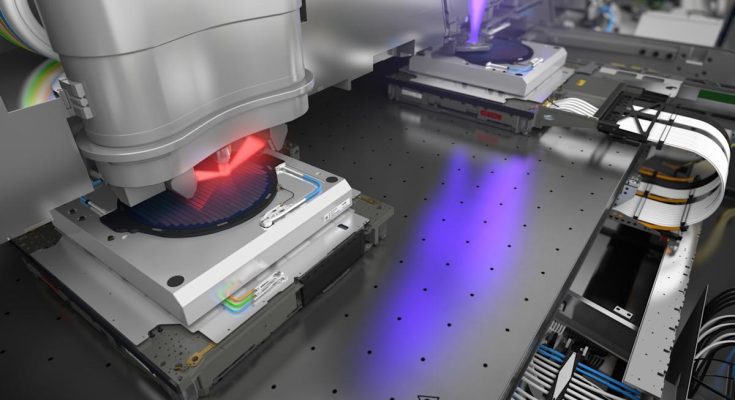

ASML’s extreme ultraviolet lithography machines are essential for making the most sophisticated AI chips.

-

These machines make up an increasingly large amount of ASML’s sales, which should gradually expand margins.

-

ASML is a top growth stock to buy and hold for years to come.

-

10 stocks we like better than ASML ›

After a brutal sell-off in April, ASML (NASDAQ: ASML) has fully recovered and is now up a staggering 45.7% year to date, compared to 13.4% for the S&P 500 (SNPINDEX: ^GSPC).

Let’s dive into the semiconductor equipment company’s third-quarter earnings and full-year guidance to see why it can continue crushing the S&P 500 in 2026 and beyond.

In the third quarter of 2025, ASML landed 7.5 billion euros in net sales and guided for 9.2 billion to 9.8 billion euros in fourth-quarter sales — which would be around 32.5 billion euros for the year. That figure is right at the midpoint of what ASML had initially forecast when it reported its full-year 2024 results in January.

ASML expects a gross margin a bit above 52% for the full year. It also reaffirmed its 2030 goals for revenue between 44 billion and 60 billion euros and gross margin between 56% and 60%.

ASML’s margins will increase as its next-generation extreme ultraviolet (EUV) systems make up a growing share of its revenue mix. In its latest quarter, ASML booked sales for 9 EUV machines, one of which was a high-numerical aperture (high-NA) system.

High-NA is the most advanced version of ASML’s EUV offering. Based on EUV sales of 3.6 billion euros, simple math tells us that ASML’s 9 EUVs were sold for an average price of 400 million euros each. And combined, these nine units made up nearly all of ASML’s sales for the quarter, showcasing how EUV is transforming ASML’s business and the composition of modern-day semiconductor fabrication plants.

EUV represents a new age in chip manufacturing. These machines are expensive, but they allow fabrication plants to fulfill complex designs for artificial intelligence (AI) applications. EUV uses light with a wavelength that is around 14 times shorter than traditional deep ultraviolet machines (which ASML also makes). These shorter wavelengths allow for the printing of smaller features with fewer steps. Put another way, it results in more transistors per chip, and higher transistor density means more computing power and efficiency.

EUV is critical for fulfilling orders of particular chips, specifically nodes below 3 nanometers. EUV will play a growing role in semiconductor manufacturing as chip designers like Nvidia, Broadcom, and Advanced Micro Devices continue to push the bounds of chip architecture to handle complex workloads.