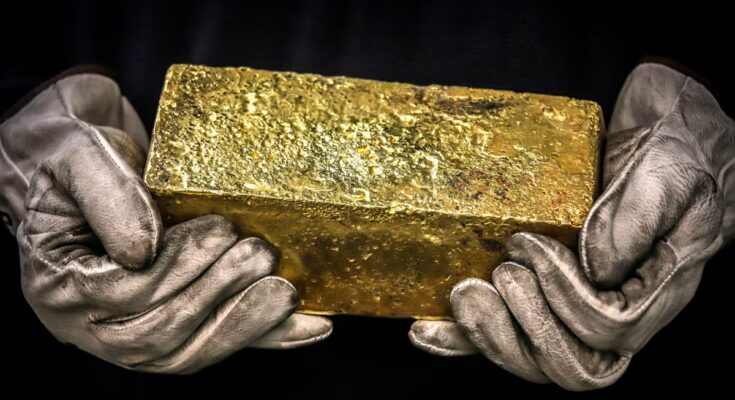

The price of gold is reaching historic highs and, according to market experts, China is one of the main invisible players behind this unstoppable growth; for some, the most important protagonist. The precious metal appreciated by more than 40% in 2025 and reached $4,380 an ounce in October, an all-time record – although it has collapsed in recent weeks – in a context of growing propensity on the part of central banks to strengthen their reserves with assets considered safer. Despite this being a global trend, several analysts highlight Beijing with particular insistence: they agree on the fact that the Asian giant seems to acquire volumes of gold much higher than those publicly declared and that this additional demand, which is not shown in the records, is acting as one of the determining factors of the greater rally of gold in decades.

Independent reports paint a very different picture than that offered by official statements from the People’s Bank of China (PBOC, the central bank). The dance of numbers, echoed by consultants at several international investment banks, fuels widespread suspicion that a significant portion of Chinese purchases go undisclosed, in a strategy aimed at protecting against geopolitical risks and reducing dependence on the US currency and assets at a time of growing international fragmentation.

Rising prices are partly a glaring reflection of a harsh and uncertain world. Hoarding gold “is a way to have security to protect your currency,” says Michael Haigh, global head of commodities research at Société Générale, on a video call from London, one of the key markets for the metal.

Haigh places the beginning of the Chinese strategy after the invasion of Ukraine by Russia, one of the world’s leading gold producers. The West has decided to freeze and immobilize its assets abroad (including gold) as punishment, and many governments have taken notice. “Countries that wouldn’t want measures taken against them have started to worry and want to put their gold back where it is,” he notes. The arrival of US President Donald Trump has accelerated the process. “There was a desire to distance ourselves from American assets because they too could be confiscated,” he underlines.

As reported by PBC, China has chained 12 months of purchases and, at the end of October, its official assets amounted to 2,304 tons of gold, equal to 8% of its foreign reserves. The Asian giant is the sixth largest gold holder in the world, according to the World Gold Council (World Gold Councilthe main international organization in the sector).

However, Bruce Ikemizu, director of the Japan Bullion Wholesale Market Association (JBMA), is among analysts who estimate that “total PCB reserves are more than double (the declared ones); they are around 5,000 tons.” This figure would catapult China into second place and substantially reduce the gap between it and the United States, which had 8,133 tons at the end of the third quarter.

Ikemizu explains to EL PAÍS from Tokyo that for months the BPC has been “reducing its dollar position and increasing gold purchases”, which in practice means a “reorganization of its reserve portfolio” to depend less on the US currency.

The gap between official data and real flows is also reflected in Société Générale’s estimates. Based on the contrast between bullion imports, domestic production and official reserves, the French bank suggests Beijing could have added as much as 250 tonnes of gold to its coffers this year, although it reported only 25.

This annual gap fits into a Chinese dynamic that the French entity has observed since the Russian invasion of Ukraine. Their analysis, based on UK gold exports – one of the most reliable gauges of the physical movement of bullion – indicates that China has added more than 1,080 tonnes of gold to its coffers since mid-2022. It has not done so through one-off purchases, but rather through steady and sustained accumulation. According to their calculations, Beijing buys an average of 33 tons per month during periods of activity, a pace moderate enough not to destabilize a market extremely sensitive to large transactions. At this rate, the country would need nearly a decade for gold to reach about 20% of its international reserves, even if it maintained a stable volume of purchases.

In any case, official data confirms that China has constantly strengthened its gold reserves since the outbreak of the war. The BPC resumed metal purchases at the end of 2022 after three years without movement: it added 62 tonnes in November and December and, with that, surpassed the 2,000 tonnes mark for the first time. The trend accelerated in 2023 with the acquisition of 225 tons, making Beijing the largest single buyer among central banks. In 2024, however, the pace moderated: it declared 44 tons (almost all between January and April, before a seven-month pause) and ended the year at 2,280 tons, equal to 5% of its foreign assets.

“What is striking this year is that China, despite prices at record levels, continues to declare its purchases. There have been periods in which it has not reported changes in its reserves, but this time it has done so, even if it was only by a ton. The message to the population is clear: buying gold is a good idea,” emphasizes Adrian Ash, director of research at the London-based BullionVault platform, over the phone. For him, knowing the exact figure of what central banks are buying is “ultimately impossible to know”, unless they communicate it.

The traditional interest of investors in finding refuge in periods of volatility also contributes to the increase in prices. With profitability at an all-time high, markets in Shanghai, New York and London are buzzing as mines are at full capacity and exploration is paying off. China, which is the world’s largest gold producer, accounting for nearly 10% of global output, announced last week the discovery of a gold deposit with reserves of more than 1,400 tons, the largest since 1949, according to state media.

Unfortunately, Ash reasons, all this is the dark side of a geopolitical scenario of “fear and mistrust” between countries. Recall that it has been documented that Russia paid for the supply of Iran’s kamikaze drones with gold bars; and goes back even further, to Libyan dictator Muammar Gaddafi’s obsession with accumulating tons: “It’s a very useful resource in times of civil crisis,” he says. Therefore, when one observes that central banks of countries as diverse as India or Poland – which have been buying gold massively since 2022 – are accumulating reserves, one concludes that it is not a good sign for global stability.

“We are in a multipolar world,” summarizes the Japanese Ikemizu. If before the United States was the strongest country militarily and economically, now numerous governments have stopped following it. The dollar remains the most powerful currency, but other safe havens are chosen. “What will you trust?” Ikemizu wonders. In the Russian ruble? In the euro or the Japanese yen, which are somehow part of that Western world? “The only currency they can trust now is gold.” He doesn’t remember seeing so much effervescence in his 39 years in the industry.

Analysts insist this is not a bubble. Haigh, of Société Générale, predicts that it will still manage to break the $5,000 barrier, in a sustained long-term climb. He believes central banks, led by China, will avoid buying now, so as not to overheat the market and further trigger prices. They will go little by little, they will buy for years. “It’s a general tendency for people to diversify,” concludes Haigh. “We live in a different world, don’t we?”