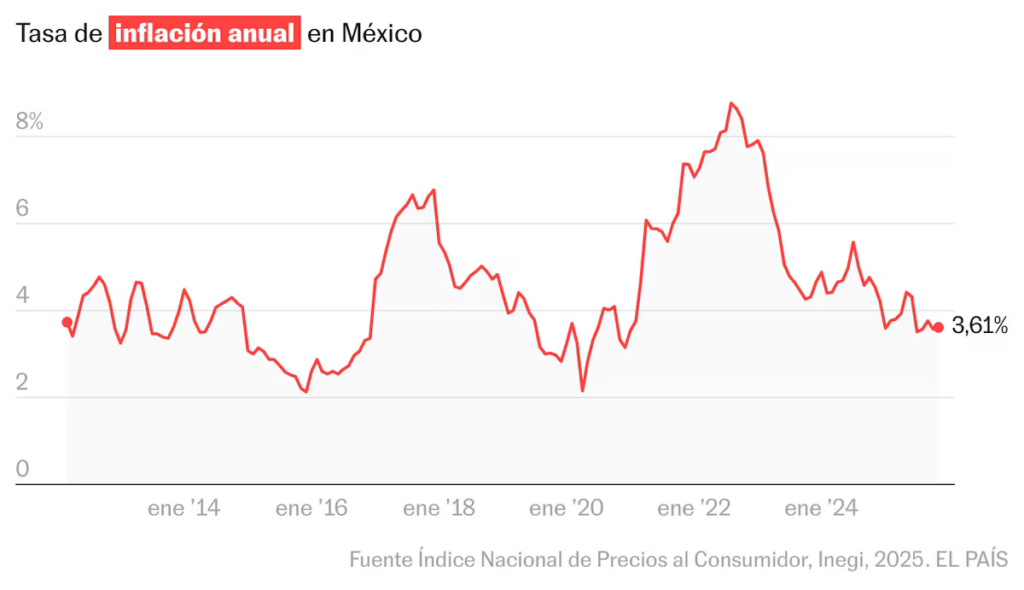

Inflation in Mexico is regaining momentum. The national consumer price index (INPC) stood at 3.61% on an annual basis in the first half of November, according to data published this Monday by the National Institute of Statistics and Geography (Inegi). The indicator stood at 3.57% at the annual rate at the end of October, a month in which the agricultural sector did not show significant increases.

In November, inflationary pressures were concentrated in the increase in electricity and public transport tariffs in some regions of the country. Inegi attributes the increase in electricity prices to the end of the summer season electricity tariff schedule in 11 cities across the country. The price increase was also reflected in loncherías, inns, pastry shops and taquerias, as well as professional services.

Core inflation, which determines the trajectory of general inflation in the medium and long term, shows an annual increase of 4.32%. For its part, non-core inflation, which includes government and regulated rates, stood at 1.29% year-on-year. According to the Banamex Economic Studies Center, the prices were offset by discounts on some products during Buen Fin.

The market estimates that the upward trajectory of inflation will continue over the next month and into early 2026. “We expect a rebound in annual inflation in early 2026 as a result of the effects of the tax increase. We expect annual headline inflation to be around 4.5% in the first quarter. On the other hand, we expect the policy of significant minimum wage increases to continue, with growth for the following year of around 11%. Hence, pressure on prices associated with labor costs will persist,” according to the estimate of the Banamex Economic Studies Center.

The Bank of Mexico expects its next monetary policy announcement on December 18. It will be the latest in a year in which the entity’s Board of Directors has opted for interest rate cuts in the face of the slowdown in the Mexican economy. The reduction in interest rates aims to stabilize prices and promote consumption. “Given the rebound in inflation and the risks that it will continue to rise, Banco de México is not expected to cut the interest rate in December, regardless of what the Fed does,” says Gabriela Siller, director of economic analysis at Banco BASE.