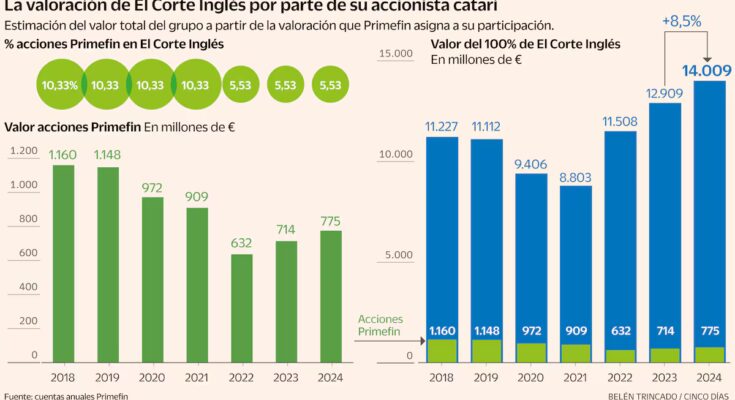

The Qatari shareholder of El Corte Inglés gives the department store group the highest valuation since it became part of his capital. Primefin, the Luxembourg company of Sheikh Hamad bin Jassim bin Jaber Al Thani, has revised upwards the valuation it attributes to the 5.53% stake it holds in the Spanish company, bringing it to almost 775 million euros, an increase of 8.5% compared to its previous valuation.

This is reflected in the accounts that Primefin has filed in the Luxembourg commercial register, relating to the 2024 financial year and delivered at the end of October. That valuation of 775 million euros implies attributing 100% of El Corte Inglés a value of 14,000 million, the highest since Al Thani joined the company in 2015: first with a participation loan of 1,000 million euros which he then exchanged for 10.33% of the shares. In 2022 it sold half of that stake for 500 million, which meant valuing the group at 9 billion.

The valuation that Primefin gives to its shares has been increasing for three years, after the correction suffered in 2020 and 2021 due to the pandemic and the effect it had on retail trade. In 2021, the Qatari investor valued 100% of El Corte Inglés at €8,803.4 million, meaning that figure has increased by 60% since then.

In the accounts of each financial year, the Al Thani company carries out a review of the fair value of its shares in the company chaired by Marta Álvarez, the only asset that appears on its balance sheet. In fact, Primefin was created exclusively to channel your investment into El Corte Inglés. This review is carried out using the discounted future cash flow method, which defines the value of the shares through a series of percentages linked to future cash generation scenarios. If those forecasts increase, the stock’s valuation also increases.

The 774.7 million at which Primefin values its 5.53% of El Corte Inglés today represents an increase of almost 61 million compared to the previous year’s valuation. This amount is recorded as financial income in the profit and loss account, being its most important variable. For example, the dividends that this company received from the distribution group were 9.5 million. Primefin’s net profit at the end of the year was 31.1 million, 11.6% less, given that the revaluation of the share package was slightly lower than that recorded the previous year.

Al Thani’s investment reached its maximum valuation at a decisive moment for the sheikh’s stay in the capital of El Corte Inglés. As defined by the parties in the agreement signed in 2015, Primefin had the option to execute the unilateral sale of the group’s securities if the group did not carry out an IPO or any other event within that 10-year period that would allow it to liquidate its investment in the company.

On July 14 this year, when the option expired, Al Thani chose to continue in the group. At the moment, its situation does not invite us to rush out: its debt is at the lowest level in the last 17 years, it has the investment grade of the rating agencies and, above all, it has intensified its dividend policy. The 225 million approved at the last meeting represents a historic record in the history of the group. Of these, more than 12 correspond to the Qatari investor.

2028, the next key year

Once the first exit window closes, the countdown to the second begins. Al Thani will not be able to leave El Corte Inglés until July 2028, as stated in his agreement with the club. It is the second of the windows, since if you don’t run it, you will have two more in 2031 and 2034.

But 2028 could be a key year for the future of the Qatari investor. In recent months it closed the extension of a 300 million euro loan with Deutsche Bank, with which it signed a financing agreement in 2020 through the Regis Spain company, also Luxembourg and owner of 100% of Primefin.

That financing agreement expired, in its original terms, in 2023, but has been extended twice until March 2025. Regis Spain’s financial statements show that this date has been extended for a further three years, paying an interest rate equal to Euribor plus 1.75% until it expires in March 2028.

This operation affects El Corte Inglés, to the point that, as part of this credit, the Sheikh of Qatar has once again put his shares in the group, pledged by Deutsche Bank, as collateral. This means that, in the event of any default during his tenure, the financial institution could receive 5.53% of the distribution group’s shares.

A situation that was already reflected at the time of signing the original loan, in 2020. This led the president and CEO of Deutsche Bank in Spain, Antonio Rodríguez Pina, to participate in the board meetings of El Corte Inglés in 2022 as a permanent guest, although without having a voice or vote in this regard. As this newspaper has learned, Rodríguez Pina maintains this status and participates in appointments with the governing body. In 2022, Primefin left its chair there, once the sale of half of the 10.33% stake it held in the group was completed.