Uncertainty is a bad thing, both in individual and national life. Or not?

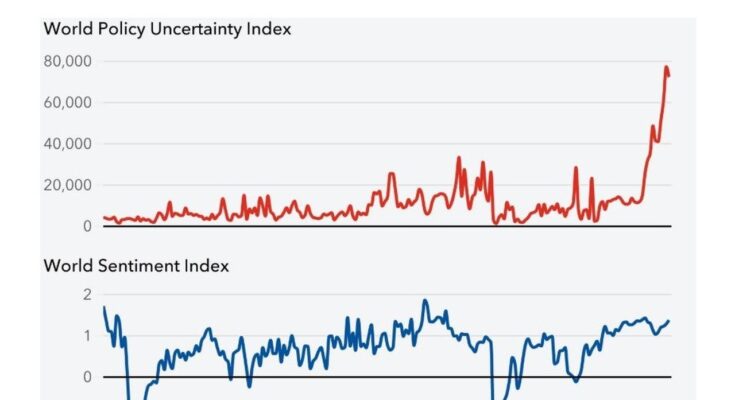

Attractive Monetary Fund charts shows a paradox: despite the extraordinary surge in the uncertainty index – to the highest level in decades, even higher than in the years of the Great Recession or in the years of the pandemic – Economic “sentiment” is still high.

Let’s see, before explaining the paradox (will we succeed?), how these uncertainty and sentiment indices are constructed. For a long time economic analyst they complain that economic data is not available on time: it is like – they say, not without reason – driving while looking in the rear-view mirror. But telematics comes to the rescue, building indices in real time, from restaurant reservations to purchasing plane tickets…to the frequency of certain words in the media and in the media, including social media. This latest information – word frequencies – is used by IMF analysts to compile these indices, which draw on data from 71 countries, including developed, emerging and developing countries. All these countries are covered by the Economist Intelligence Unit, which publishes regular reports in English. In these reports the words “uncertainty”, “uncertainty” and “uncertainty” are taken into account, in the sections of the text that refer to economic policy, as well as politics.

“Resources”, agricultural waste to save the region

The “feeling” index. covers the same 71 countries, and goes through a list of words suggested in a 2016 paper by Herman Stekler and Hilary Symington for the purpose of assessing the economic outlook. In this case a list of word groups and weights of positive words such as “solid” and “stable” and negative terms such as “crisis” or “recession” with appropriate weights.

TASK

As seen in the panel referring to Sentiment, this collapsed in the dark years of 2007-2008 (Great Recession) and 2020 (Covid). Then prices rise again, and remain at relatively high levels, even if, in April 2025 (coinciding with the announcement of import duties on everything and everyone – the famous Independence Day) they experience a considerable decline. Judgment, this, is even more so Dana macroeconomically emphasized, with an increase in the world economic growth forecast in the October World Economic Outlook (WEO) (to 3.2% in 2025, compared with 2.8% in the April forecast).

How to explain the difference between uncertainty and feelings? The IMF doesn’t say much on the matter: the economy’s resilience to the “darts and arrows of bad luck” can be put down to a few words: “better policies, especially in emerging markets, and better adaptability of the business world”. Let’s try to strengthen it.

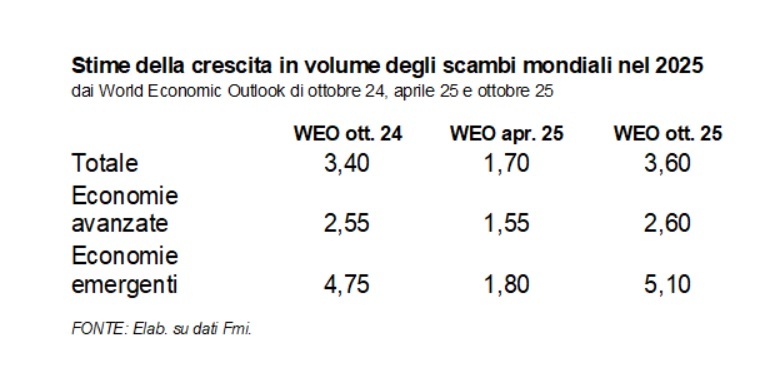

World Economic Fund Forecast in April (2.8%) marked a clear slowdown compared to WEO on October 24 (3.2%). In this case, the latest estimates just mentioned go back to last year’s estimates, before Trump and the tariffs. It is as if nothing had happened, as if all the sand we threw into the cogs and wheels of international exchange had produced no results. And we come to the “better business adaptability” cited by the IMF.

What does river water do when it encounters an obstacle? It depends on the obstacles, but there is no turning back. It goes beyond it, beyond it… And this is what the international exchange has done. For a short time they slow down. Maybe there is fewer steps at re-export centers, such as in the Netherlands or Singapore, perhaps companies have ‘adapted’ to imaginative solutions, some legal and some illegal, but the imposition of import duties has proven less deadly than a bark. Many of the initial fears were exaggerated. Why should Italian Prosecco producers be afraid of import duties? Are they afraid that Americans will instead buy champagne, which costs at least twice as much? Or that California wine producers will sell American Prosecco (which they can’t do, the brand is protected)… Or that Spain or France will sell more Cava or more Blanc de Blancs (but they are subject to the same duties)…

In short, Trump’s tariffs have caused changes in trade between geographic regions, but didn’t fall. On the contrary: the table shows how the growth in world trade volumes for the year coming to an end is even better, based on the latest data, than the forecast for October 2024 (pre-import duties), both for developed countries and, moreover, for developing countries. We can see how last April the IMF forecast failed: tariffs became a reality. But now those fears have passed, trade has recovered, and the economy has learned to live with uncertainty. The mighty tide has overcome existing obstacles, and the “death of globalization,” as Mark Twain put it when announcing his death, has proven premature.