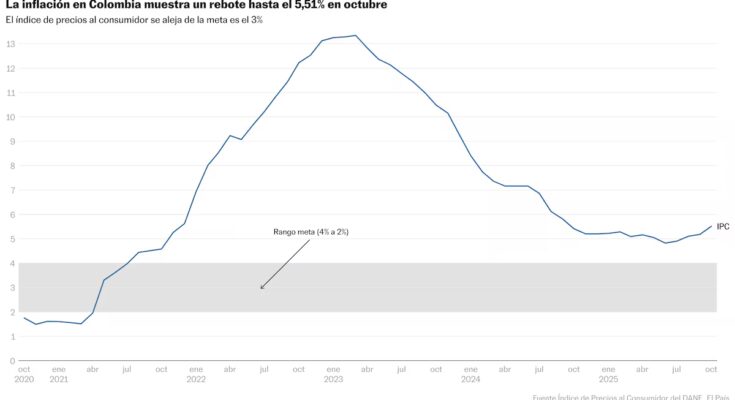

Inflation accelerates in Colombia. The consumer price index (CPI), which measures the increase in prices of goods and services, stood at 5.51% per year, according to the technical bulletin published this Monday by the National Administrative Department of Statistics (DANE). The data implies a rebound of 33 basis points from September figures (5.18%) and the highest figure since September 2024. Thus, the battle to keep inflation in the 3% range now amounts to 51 consecutive months of defeat for the Bank of the Republic.

The monthly change was 0.18%, lower than the 0.32% observed in September, but sufficient to consolidate the fourth consecutive month of rising annual inflation. The increase was driven by the segments recreation and culture (0.81%), healthcare (0.65%) and accommodation, water, electricity, gas and other fuels (0.41%). Among the subclasses with the greatest contribution, complete tourist packages (3.36%), water supply (1.56%) and beef and meat products (1.04%) stand out. In contrast, fresh food products moderated the progress: tomatoes decreased by 19.6%, onions by -4.9% and potatoes by -2.55%.

By breakdown, the annual behavior shows that the greatest pressures are on prices of education (7.36%), restaurants and hotels (6.18%), healthcare (5.97%), food and non-alcoholic beverages (5.94%), alcoholic beverages and tobacco (5.54%), all above the national average. The remaining divisions are below average: transport (4.62%), accommodation, water, electricity, gas and other fuels (4.39%) and various goods and services (4.20%).

The consensus was clear: October would mark the highest annualized value of the year, with a clear rebound in prices. Corficolombiana was aiming for 5.5%, while BBVA Research was aiming for 5.4% and Fedesarrollo was aiming for 5.47%. Citi Research showed a range oscillating between 5.38% (Anif) and 5.56% (Grupo Bolívar). Today’s data is in the high range of forecasts.

Now it is very likely that the Bank of the Republic will maintain caution in its monetary policy. Already at the last meeting it kept the interest rate at 9.25% (unchanged since April), and the new data reinforces the expectation that there will be no further cuts in the rest of the year. From the minutes of the Central Bank emerges concern about the persistence of inflation in the components indexed to the minimum wage and in regulated prices.

Although some Council members suggest cuts of up to 50 basis points, caution remains in the face of fiscal and exchange rate risks. Along the same lines, Cibest Group (formerly Bancolombia) warned that October will occur in an “environment characterized by upside risks”, with pressure on goods such as beer, pharmaceuticals and hygiene items, and an indexation effect “higher than desirable to achieve faster normalisation”. The monetary authority’s room for maneuver remains limited. The Western Bank expects rates to remain unchanged for the rest of the year.