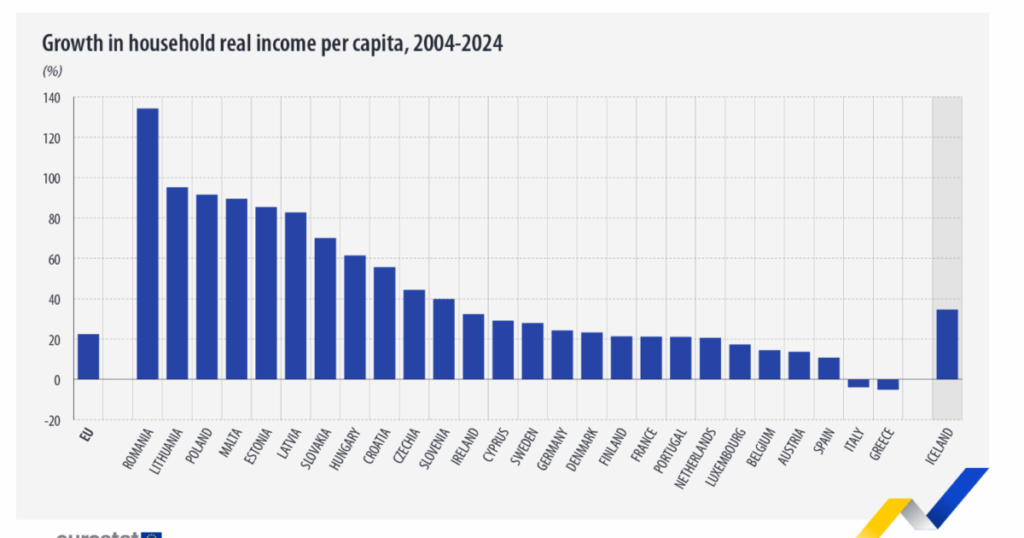

Growth flooded, firm real wages the vulnerability of unintentional accomplices and part-timers, is greater vulnerability in inflation shock caused by rising energy prices following Russia’s invasion of Ukraine. The result: Italy, together with Greece, is the only country in the European Union that in the last twenty years real household income per capita has decreased. Meanwhile, the Twenty Seven average between 2004 and 2024 has increased by 22%Roma and Athens closed the period in the red zone. Each for -4 And -5%. This is the latest data released by Eurostatwhich states a structural problem.

The graph published by the European Union Statistical Office is truly cruel. From 2004 to 2008, real incomes continued to rise across almost the entire EU. Then from 2008 to 2011 global financial crisis cause one stagnation and between 2012 and 2013 there was a decline. From 2014 to 2019 the trend was positive again, until a new slowdown occurred as a result pandemic in 2020. Recovery occurred in 2021, but was followed in 2022 and 2023 by weak growth, pressured byinflation. Nonetheless, the first data for 2024 shows acceleration: a sign that many countries are catching up. Not Italy.

Looking at the data for individual EU states, the gaps are clear. Countries that enjoy convergence with Western Europe thanks to their best performance also enjoy it foreign investment and lively production dynamics: Romania (+134%), Lithuania (+95%), Poland (+91%) and Malta (+90%). But even developed countries, although at different rates, recorded progress: +11% for Spanish+14% forAustria+15% for Belgium and +17% for Luxembourg. In the France revenue rose more than 21%, in German as much as 24%.

However, Italy remains one of the few countries where family purchasing power, adjusted for inflation, is lower today than it was twenty years ago. An anomaly reflecting a combination of low growth, productivity stop, weak job marketvulnerability to energy shocks and energy attacks price.