The news of King Dollar’s death, to paraphrase Mark Twain’s famous denial of his own death, turned out to be decidedly exaggerated. The first moments of Donald Trump’s administration have drawn rivers of ink on the danger that this version 2.0 of the Trumpeconomy could represent for the global hegemony of the greenback, in decline over the decades, and on the exorbitant privilege it entails for the country’s public debt. However, amidst the noise and the astracanadas, the tariff war and the thousand and one contradictions, Washington moves the cards to strengthen the throne.

In short, there is a Make the dollar great again in grass. The government is very aggressively developing the market stablecoins (a cryptocurrency with a stable value that acts as an alternative payment system to current currency), which in the world is almost all linked to the US currency. This boom, which already reaches astronomical figures, represents a new form of indirectdollarization. At the same time, as progress Financial times Earlier this month, senior government officials explored the possibility of encouraging other countries to adopt the currency, as Ecuador and El Salvador did 25 years ago, and held meetings to that effect with several experts, including Steve Hanke, a veteran inflation and currency specialist at Johns Hopkins known in some circles as “Doctor Money.”

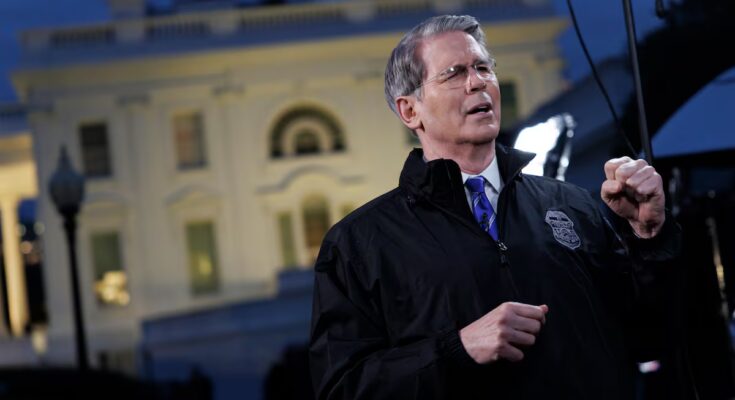

Hanke confirmed the meeting to EL PAÍS, which took place at a time of turbulence in Argentina, although he underlines, as the Government did when the information emerged, that no decisions were made in this regard: “While the Trump administration has a well-articulated policy on the issue stablecoins based on the dollar, has yet to establish a more comprehensive strategy to promote the use of the dollar,” he says. stablecoins They are virtual currencies like all cryptocurrencies, but designed to maintain a less volatile value and are linked to a specific asset. They are used both for the exchange of other cryptocurrencies, for the payment of goods or for international money transfers. Today 99% of all those in circulation in the world – and there are already 225 billion, according to JPMorgan – are denominated in dollars. It is a kind of digital dollar, but issued by the private sector, unlike the initiatives of the eurozone or Beijing.

By 2028, some reports suggest that this market will have reached three billion. Washington has been very explicit about its expectations for the new currency. Last July the Genius Act was approved, the US law that very decisively regulates digital assets and their growth. Treasury Secretary Scott Bessent later said that this type of technology “will strengthen the dollar’s status as a global reserve currency and lead to increased demand for U.S. Treasury securities, which support the stablecoins“Moreover, it “could push millions of new users, around the world, into a dollar-based digital asset economy.” When the financial world talks about the “exorbitant privilege” of the dollar, it is referring, to a large extent, to the demand for US government debt cited by Bessent. The lower cost the US pays to finance its large liabilities, which exceed 120% of its gross domestic product (GDP). The country already pays more interest on debt than on defense. stablecoins They are guaranteed by Treasury securities.

How strong does the greenback’s hegemony remain? The dollar today represents 58% of the total world currency reserves (the euro, in second place, reaches just 20%). That almost 60%, in fact, represents a notable dominant position, but pales in comparison to the 1970s, when it exceeded 80%, and also represents the low level of the last two decades. The pre-eminence has eroded and Trump, for his part, has played with trade games, but this does not imply that any currency can take the throne from the dollar in any conceivable future. As Joseph Gagnon, finance expert at the Peterson Institute for International Economics, explains from Washington, “there are currently only two possible competitors, the euro and the yuan. People are afraid to entrust their money to the Chinese, whose authorities maintain strong obstacles to the movement of capital in and out of the country. Europe is too fragmented to challenge the dollar, it needs more unified banking, financial and fiscal systems, with a large central budget and a single Treasury, as in the United States (…). When this happens, the dollar will face competition realism”, he concludes.

Cryptocurrencies, of course, don’t seem like the way to go surprise of the euro against the dollar. Santiago Carbó, researcher at Funcas and professor of Economics at the University of Valencia, warns of the danger of Europe “missing the opportunity” with digital currencies. «Visa and Mastercard are already American, if you don’t follow the trend stablecoinsyou will definitely find yourself out of place in the global payment systems market.”

In addition to virtual currency, there are other ways to encourage the use of the dollar, explains Steve Hanke. One is known as a “currency board,” where the national currency is issued and exchanged at a fixed rate against the dollar and is fully backed by the note. Another is direct dollarization, which involves removing the original currency “into a museum” and replacing it with American currency. The expert, who uses his experience in projects such as thedollarization programs of Montenegro (1999) and Ecuador (2000), among others, advocates a policy that touches on all three possibilities. In his opinion, this would not only be an advantage for the United States, but also for the countries that have adopted it.

It’s a widely discussed opinion. For Gagnon,dollarization constitutes “an act of desperation” by some economies that is “difficult to reverse” and he doubts anyone will. In some countries it has been a form of discipline and has served to control inflation, but it means taking over the monetary policy of the Federal Reserve and handcuffing countries when they face crises. Likewise, the flood of stablecoins it complicates the control of capital and the possibility of devaluing the currency. ECB President Christine Lagarde has warned against the rise of these cryptocurrencies, which are particularly attractive for facilitating faster and cheaper international transactions. “These assets are not always able to maintain their fixed value,” he said at a hearing before the European Parliament last June. Furthermore, he warned that a possible transfer from the bank to stablecoins in deposits used for savings and payments “could negatively influence the transmission of monetary policy through banks”, i.e. the central bank’s measures could see their effect on the real economy diminished. Therefore, he advocated strong regulation.

At the same time, the global role of the euro has gained greater importance in Frankfurt. “The change in outlook (referring to the protectionist turn) could open the door for the euro to play a more important international role,” he had said just a month earlier in Berlin. The digital euro has already become, in parallel, a priority on the financial agenda of the European Union. Because, in fact, and like many things in the Trump universe, the strategy of promoting dollar hegemony contradicts other policies of the Administration. Its value fell by around 10% against other hard currencies in the first half of the year and, as regards the euro specifically, it has never recovered the level before the announcement of the big tariff wave on 2 April this year, the so-called “Liberation Day” (see chart).

A cheaper dollar would help reduce the trade deficit that worries Trump so much, but which clashes with his desire to preserve “exorbitant privilege.” What then is the priority objective? Tariff and commercial promotion policies stable currency based on the dollar, even if they seem inconsistent with each other, they coincide in one function: both serve to help finance the fiscal deficit. Cryptocurrencies can also make the Trump family, who has bet big on it, immensely rich.