This re-evaluation aims to better consider so-called “comfort” criteria, such as the presence of running water, electricity, toilets or washbasins in the accommodation.

/2023/07/06/64a68815cd1a7_placeholder-36b69ec8.png)

Published

Reading time: 1 minute

/2025/11/18/050-only-0258362-691ce2395a74e808610400.jpg)

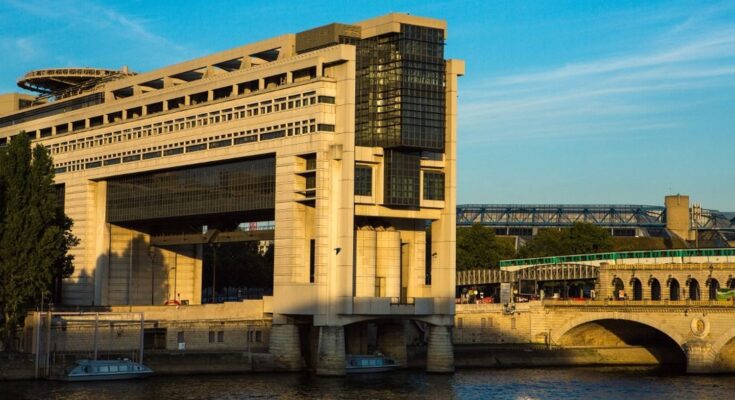

Housing data updates by the Ministry of Economy will lead to an increase in property taxes for 7.4 million housing units in 2026, Bercy announced to AFP, confirming information from the Ministry of Economy. Paris. “This is a question of tax efficiency and fairness : that each person pays according to the type of housing he has”confirmed to franceinfo the office of the Minister of Public Accounts, Amélie de Montchalin.

Paid by about 32 million owners, this property tax, in addition to the surface area in square meters, is based on so-called “convenience” criteria such as the presence of running water, electricity, a toilet or sink in the house. The presence of each of these elements artificially increases the number of square meters taken into account, and mechanically the amount of property tax.

“Operations to make land bases more reliable to be carried out in 2026” aims to take into account “these comfort elements are not currently integrated into the foundation”explained Bercy to franceinfo. According to Parisianthis update will result in an average increase in housing tax of 63 euros per affected accommodation and will generate an additional 466 million euros for local authorities.

Owners who are not equipped with these installations will be able to submit disputes, he explained Ministry of Economy to franceinfo.