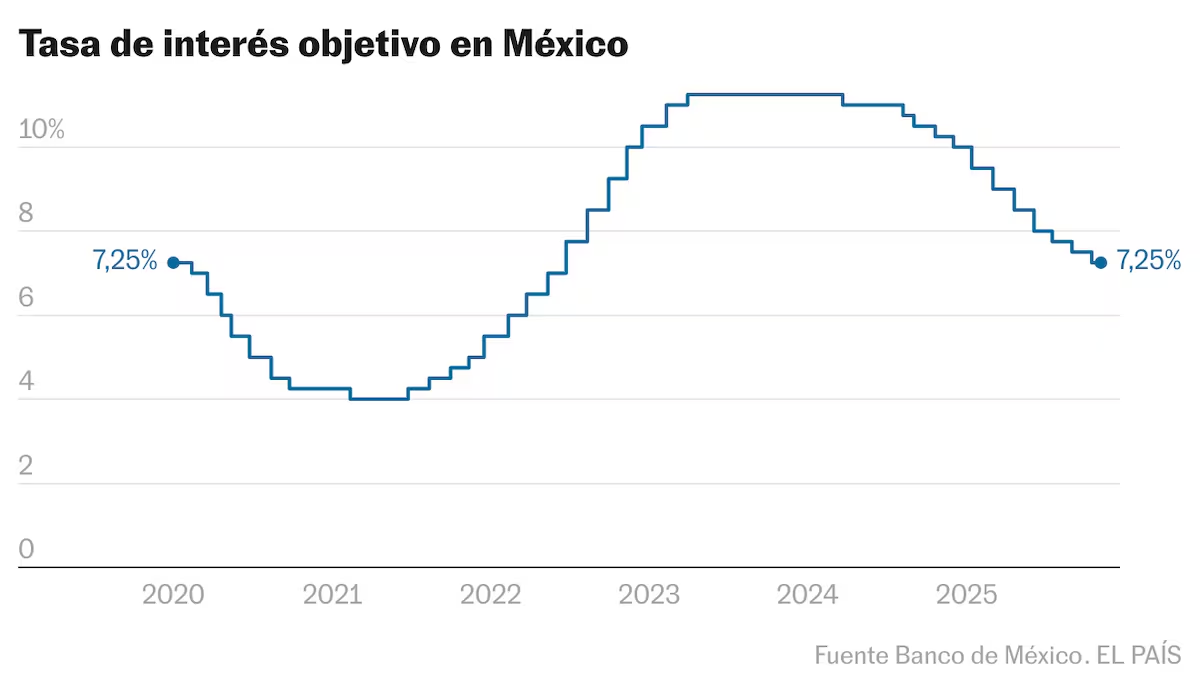

The Bank of Mexico decided this Thursday to lower the interest rate by 25 points and set it at 7.25%. “The Board of Directors considered it appropriate to continue the cycle of policy rate cuts. This is consistent with the assessment of the current inflation outlook. In particular, it considered the behavior of the exchange rate, the weakness exhibited by economic activity and the possible impacts of changes in trade policies globally,” the organization said in its note. The interest rate reduction comes just days after confirmation of the Latin American country’s economic slowdown. In the third quarter of 2025, gross domestic product (GDP) fell by 0.3%. The debacle was caused by the weakness of the industrial sectors: manufacturing, mining, construction and energy. The cut was obtained by majority vote. The governor of the Bank of Mexico, Victoria Rodríguez, and the deputy governors Galia Borja, José Gabriel Cuadra and Omar Mejía Castelazo spoke in favor of the decrease. Only Lieutenant Governor Jonathan Heath voted in favor of keeping the interest rate at 7.5%.

Following this decision, the Bank of Mexico maintains its less restrictive stance. The institution continued with an aggressive rate cut in the face of the weakness of the Mexican economy, the behavior of the exchange rate and the possible impact of changes in global trade policies. The central bank acknowledged that Trump’s tariff measures “continue to add uncertainty to forecasts” and could imply “pressure on inflation.” According to the institute’s analysis, upside risks to inflation include exchange rate depreciation; the persistence of underlying inflation; disruptions due to geopolitical conflicts and cost pressures.

A lower interest rate promotes consumption and other productive activity, which usually increases investment, key elements in these times marked by the economic slowdown and nervousness over the tariff threat from US President Donald Trump. The current round of rate cuts by the Bank of Mexico began in March 2024. Markets expected the current monetary policy decision because members of the bank had subtly revealed their intention to continue with cuts.

Alfredo Coutiño, Latin America director of Moody’s research unit, says the central bank’s board is concerned about the poor performance of the country’s economy and, therefore, rushed to ease monetary tightening this year. “The Bank of Mexico has a single constitutionally assigned monetary mandate, which is price stability, but in practice the authorities have applied a double mandate. The decision increases the risk of incomplete monetary adjustment that could delay inflation convergence beyond 2026,” it says.

The rate cut continues in an up-and-down inflationary environment. In the first half of October the price increase stood at 3.63% on an annual basis, a slight decrease compared to the end of September, when it was 3.76%. Despite this respite, inflation remains below the Bank of Mexico’s 3% target. This Thursday the institution revised its forecasts for annual general inflation downwards and expects it to end 2025 at 3.5%, compared to the 3.6% previously estimated. “The Central Bank reaffirms its commitment to respecting its priority mandate and the need to persevere in its efforts to consolidate a context of low and stable inflation,” recognizes the Bank of Mexico.