The Attorney General’s Office (FGR) has taken over the investigation into the illicit millionaire investments of the Autonomous University of Aguascalientes (UAA) in the purchase of junk bonds. Since these are federal funds, the investigation, conducted by the Anti-Corruption Prosecutor’s Office, focuses on the crime of diverting public resources towards risky financial instruments, a practice prohibited by law, as ministerial sources confirmed to EL PAÍS. These are two equity investments worth 393 million pesos, which were not returned to the university and are considered definitively lost. The director of the UAA, Yesenia Pinzón, authorized in 2023, with her signature, part of the illicit investments – for 200 million pesos – which the Prosecutor’s Office is now investigating. Despite this, the university official is seeking re-election to the rectorship, in a vote that will take place this Thursday at the university.

As part of his electoral career, Pinzón denied, in his appearances before the university community, having had any participation in the diversion. Instead, he defended his efforts to report the crime to state agencies. However, the documentation to which this newspaper had access shows his handwritten signature on the authorizations to invest the resources. Furthermore, a complaint filed in the Superior Court of Control of the State of Aguascalientes by a former UAA director – also in possession of this newspaper – indicates that both the rector and other top officials pressured him to reserve investment income and not make it public. After following the instructions, the manager was fired and accused by the rector of having orchestrated the embezzlement. This newspaper questioned Pinzón, through an assistant, about his signature on these documents and about the pressure reported by the former director, but the rector did not respond.

The history of illicit investments dates back to 2020, to the time of former rector Francisco Javier Avelar. The complaint presented to the Court of Auditors by Enrique Jiménez, then director of the Financial Analysis Department, refers to how the first negotiations took place between the UAA authorities and the representatives of CI Banco. This financial entity, recently liquidated by the federal government after US accusations of laundering drug money, served as an investment intermediary between the university and Corafi, a front company involved in other frauds against public institutions that also fell into the junk bond trap.

EL PAÍS revealed in 2023 how the enormous Corafi and CI Banco scam worked, which to date had drained around 6 billion pesos from several federal and state entities, including the most emblematic, Segalmex, an institution created by Andrés Manuel López Obrador. The scheme followed the logic of a large-scale Ponzi scheme. Corafi and CI Banco designed a structure for the issuance of debt securities which, through a contract, were purchased by public bodies. The incentive was the promise of exorbitant returns (UAA was promised a 10% return). When it came time to liquidate the investments, bond issuers, who had no backing, turned to another agency to refinance. Federal law says it is a crime for institutions to invest public funds in risky instruments. With the exception of the case of Segalmex, where there was a political operation to recover the money, the other institutions have lost the resources given to the scammers.

In Aguascalientes, three agencies fell victim to the fraud: the Public Prosecutor’s Office (which lost 66 million pesos); the welfare fund for state bureaucrats, the ISSSSPEA (170 million) and the SAU. During Avelar’s rectorship, and without the knowledge of the University Council – the highest authority of the UAA -, an initial investment of 200 million pesos was made with Corafi and CI Banco, coming from the Stabilization and Contingency Fund. This item captures resources that are mostly federal in origin and that must be used to pay workers’ payrolls and employer obligations, such as pension contributions. In February 2023, a month after taking over as rector, Pinzón authorized the investment in stocks to continue throughout the year, or ordered their reinvestment, as stated in a document examined by this newspaper. In September, according to another internal document, the investment, which already amounted to 255.7 million pesos, disappeared from the studio’s bank statements.

A representative of the bank informed the UAA that the issuer of the bonds “did not have sufficient balance to meet the payment of obligations arising from the issuance” of the certificates. The banker also reported that he could no longer contact that issuer. In March 2023, Pinzón authorized a new investment of 100 million pesos, this time with other scammers: M3X1C0’s One card company and Covalto bank. This followed the same logic as the Corafi and CI Banco scam by issuing stock certificates without collateral. At the end of 2023, SAU’s accounts at Covalto showed 138 million pesos, also lost, since, at the beginning of 2024, the holder of the securities, Uno of M3X1C0, was declared bankrupt. Once again, this deviation was made with the signature of the rector, according to documentation examined by this newspaper, and without the knowledge of the University Council.

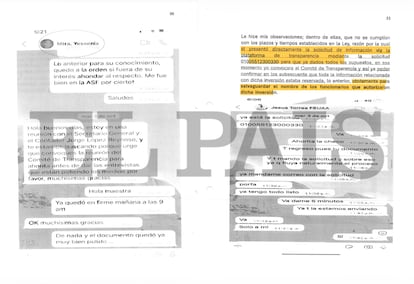

When the scandal over UAA’s million-dollar financial shortfall broke, Pinzón and the head of the Legal Department, Jesús Torres, pressured Enrique Jiménez, director of Financial Analysis and president of the Transparency Committee, to hide documentation relating to the bond purchase instructions (and which included the names of the officials responsible). Jiménez included in his complaint WhatsApp screenshots noting the efforts of the rector and the university lawyer. According to the complainant, Pinzón and Torres were “exhorted” to maintain confidentiality to prevent any officials from saying anything sensitive in interviews with the press. Jiménez complied with the instructions, but shortly afterwards, at the end of 2023, he was fired and held responsible for the diversion of resources, according to his account before the Audit.

“In October 2023, the rector Yesenia Pinzón, in various interventions in the media, falsely stated that the undersigned managed the realization of the investment, which is totally false, first of all, because it does not fall within my duties,” the former official said in his complaint. Pinzón presents herself this Thursday as a candidate to be re-elected rector of the UAA. In the first phase, students and teachers vote to choose a shortlist of candidates. This then passes to the board of directors, where nine members deliberate and appoint the head of the institution.